Tax Intern Resume Guide (Examples, Samples & Job Descriptions)

Written by: Rajat Bhardwaj

Landing a tax internship is often the first step into a rewarding career in accounting and finance. But before you get there, your resume needs to convince recruiters that you have the right mix of technical knowledge, attention to detail, and eagerness to learn.

In this guide, we’ll cover:

- What to include in a tax intern resume

- How to write the job description section

- Examples and samples

- A comparison table of strong vs. weak resume descriptions

Why a Tax Internship Resume Matters

A tax internship is competitive because it gives you hands-on experience with taxation, compliance, and client interaction. Recruiters are looking for:

- Knowledge of accounting and tax concepts

- Analytical and problem-solving skills

- Strong communication abilities

- Proficiency with tools like Excel or tax software

Also check our guide on Accounting Internship Resume if you’re targeting broader finance internships.

Tax Internship Job Description for Resume

Here’s how you can frame your responsibilities as a tax intern:

Sample Resume Job Description:

- Assisted in preparing federal and state tax returns for individual and corporate clients.

- Conducted research on tax regulations and ensured compliance with filing requirements.

- Analyzed financial documents to identify potential deductions and credits.

- Collaborated with senior tax associates to prepare audit-ready files.

- Prepared Excel spreadsheets and maintained client tax records.

💡 Pro Tip: Always tailor this section to the role you’re applying for—match your wording with the internship posting. You can explore more in our Work Experience Resume Guide.

Key Skills to Add

- Tax Preparation

- Financial Analysis

- Microsoft Excel / QuickBooks / TurboTax

- Research & Compliance

- Attention to Detail

- Communication & Teamwork

For more inspiration, check Skills for Resume.

Build Your Own Tax Internship Resume

Get access to our DIY resume template—simple, ATS-friendly, and tailored for internships.

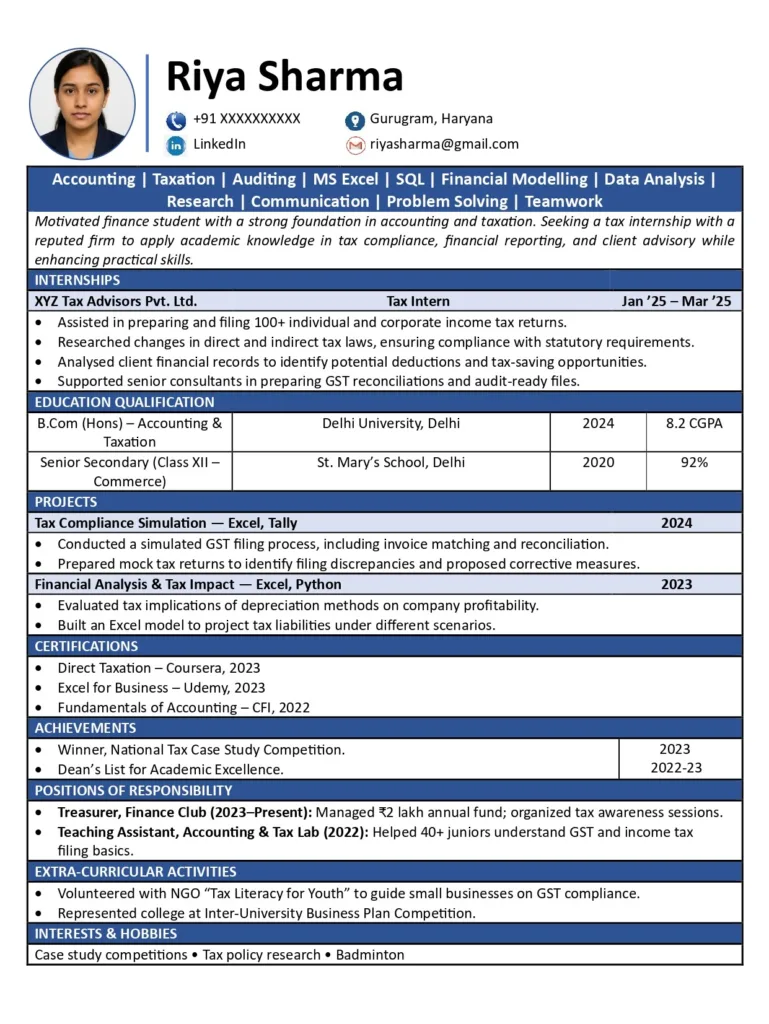

Tax Internship Resume Examples

Example 1 (For Students with Coursework)

John Doe

- Coursework: Federal Taxation, Corporate Taxation, Accounting Principles

- Prepared mock tax returns in class projects using TurboTax

- Volunteered with VITA (Volunteer Income Tax Assistance) program

Example 2 (With Prior Internship)

Jane Smith

- Assisted senior tax associates in preparing over 150 individual returns

- Conducted tax research using IRS publications and online tools

- Supported client meetings by preparing income statements

If you’re a fresher, our blog on Resume for Freshers Mechanical Engineering shows how to adapt academic projects into resume content.

Strong vs Weak Resume Descriptions

Here’s a quick table to show how you can upgrade your resume language:

| Weak Resume Description | Strong Resume Description |

|---|---|

| Helped with tax returns | Prepared and filed 50+ federal and state tax returns under supervision |

| Worked on spreadsheets | Built Excel models to track deductions and identify $10K in client savings |

| Did research | Researched IRS updates to ensure compliance with 2024 tax reforms |

| Assisted seniors | Collaborated with senior tax consultants to deliver audit-ready files |

For more tips, explore ATS-Friendly Resume Guide so your resume passes automated filters.

Tax Internship Resume Sample Format

Contact Info

Name | Email | Phone | LinkedIn

Objective

Motivated accounting student seeking a tax intern role to apply academic knowledge of taxation and gain practical experience in corporate tax compliance.

Education

Bachelor of Commerce in Accounting

XYZ University | Expected Graduation: 2026

Experience

Tax Intern, ABC Accounting Firm

- Supported preparation of 120+ tax returns (individual and corporate)

- Conducted tax law research to resolve client queries

- Maintained client data files with 100% accuracy

Skills

Tax Preparation | Research | MS Excel | Communication

For different domains, see our Business Analyst Intern Resume or Civil Engineering Intern Resume Samples.

Final Tips

- Quantify Achievements – Show numbers (e.g., “assisted with 120+ returns”).

- Highlight Tools – List software like Excel, QuickBooks, or tax preparation software.

- Keep It One Page – Especially for an internship, concise is better.

If you’re exploring other options, check our Big 4 Internship Resume guide for Deloitte, PwC, EY, and KPMG.

FAQs:

1. What should I include in a tax intern resume?

You should add your education, relevant coursework, internships, tax skills (like Excel, Tally, or QuickBooks), and any finance-related projects or achievements.

2. How do I write a tax intern resume with no experience?

Focus on academic projects, internships, volunteering, or coursework related to accounting, finance, or taxation. Highlight skills like analysis, MS Excel, and attention to detail.

3. What skills are important for a tax intern resume?

Key skills include tax preparation, GST knowledge, financial analysis, research, MS Excel, communication, and problem-solving.

4. Should I add projects to my tax intern resume?

Yes. Projects like preparing mock tax returns, GST reconciliations, or financial analysis case studies help showcase your practical knowledge.

5. What’s the difference between a tax intern resume and a regular resume?

A tax intern resume is tailored to focus on accounting, taxation, and finance-related skills, coursework, and internships—rather than broad experiences.